Every trainer has met a “wild” horse. They’re uncontrollable, always kicking, jumping, and ready to bolt. Some even bite.

For example, last year, a racehorse who was part of King Charles’ coronation process went AWOL and rammed into a crowd of bystanders.

Thankfully, no injuries were reported. However, the incident is an important reminder of what can go wrong. It also reminds us of the value of proper taming and bonding.

This guide explains how to tame a wild horse if you catch one in the wilderness or adopt a foal from the Bureau of Land Management (BLM).

What’s Taming?

Taming generally means transitioning a wild or free-roaming feral into a calm and friendly companion for domestic or sports purposes.

A few people use the same term to refer to the process of capturing a horse in the wilderness. However, we prefer to call it just capturing or catching. Taming has more to do with training.

The process is long and arduous, from gaining the horse’s trust to teaching them saddling and riding. So, it can take months or sometimes more than a year.

It’s also dangerous, given wild horses are flight animals. They defend themselves by charging, kicking, or biting if you get too close. That’s why you cannot approach, feed, or touch them in the wilderness. You must back off if the horse approaches.

Is it Legal to Tame a Wild Horse?

Yes, it is legal to tame wild horses in most countries if you follow the law. For example, Americans can adopt and tame wild horses in line with the Wild Free-Roaming Horses and Burros Act of 1971 (WFRHBA).

WFRHBA is an Act of Congress addressing the management, protection, and research of unclaimed or unbranded horses and burros found in public lands.

Notably, it criminalizes harassing, capturing, or killing wild horses and burros in public lands to protect their populations.

However, it allows the Bureau of Land Management (BLM) and Forest Service Management to remove “excess” animals. The two bodies also manage the private placement and adoption of excess animals.

As a result, BLM runs several adoption centers at designated Herd Management Areas (HMAs) where you can acquire young and mature mustangs and other ferals for as little as $125.

There’s a strict taming requirement for wild horses adopted through BLM. The agency demands a 12-month training at minimum before you can relocate the horse to your property or integrate it with other domesticated animals.

Alternatively, you can legally catch wild horses on private property. Again, it’s perfectly legal to tame the animals.

Can You Do It Yourself?

Yes, you can adopt and tame wild horses yourself. Hundreds of Americans do it yearly. Nevertheless, it’s a sport best left to the experts or highly experienced enthusiasts.

First, remember that ferals and wild horses are essentially wild animals. Like their striped cousin, the zebra, a wild horse considers humans enemies. So, an approaching human arouses the animal’s fight-or-flight instincts.

You need extensive experience to calm the horse and special skills to train them fully. Unfortunately, novices lack both.

Worse still, wild horses are accustomed to living in herds. So, a few days alone can trigger anxiety and restlessness. Again, you need experience to help them endure this period without breaking something.

Most trainers integrate them into a herd of tamed horses while keeping a close eye to avoid altercations.

Finally, do you have the time and patience? If you don’t, consider professional taming, as the process can take many months. Moreover, you must be extremely patient and consistent, repeating the same commands and instructions for days or weeks.

See: What Does it Mean to Break a Horse?

How to Tame a Wild Horse: Step-By-Step Guide

Every professional has a unique way of taming wild horses. But we can all agree on four crucial taming stages;

Step #1: Getting Ready

This step mostly involves learning about the horse and revisiting your goals. The following are a few things to keep in mind;

- Learn more about the horse: Begin by finding out the breed. Is it a Mustang? Or is it a different type of feral? Next, try to understand the horse’s personality. The issuing adoption center may have a few helpful records. Finally, assess the horse’s health status.

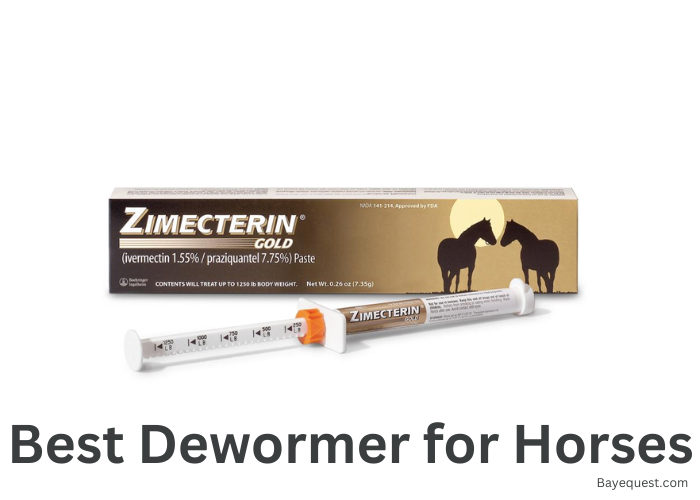

- Consider vaccination: Sometimes, the center vaccinates the horses awaiting adoption. But don’t take chances. Let a veterinarian evaluate the horse and administer important vaccinations to contain infectious diseases.

- Learn about the horse’s diet: Though horses can eat most vegetation, quick diet changes can be dangerous. For example, it can cause colic, an abdominal condition characterized by intense pain. The adoption records will give you a clue about the right diet. But don’t hesitate to see the vet.

- Revisit your goals: Why did you adopt or catch the horse? Do you want to use it for sport? Perhaps rodeos? Or are you merely seeking a new pet? The training methods should match the desired outcome.

Step #2: Earn the Horse’s Trust

Never start training until the horse knows and trusts you. Either they’ll bolt off or not listen to you. Here are a few expert ways to earn a wild horse’s trust;

- Tether the horse where they can see you: Initially, the horse will be anxious and maybe even terrified around you. To make their life easier, maintain a reasonable distance. One way to do this while keeping them in sight is by tethering the horse with a halter and lead rope. That way, they can get used to your presence without a nervous breakdown.

- Spend plenty of time around the horse: The more time you spend close to the horse, the faster they get used to you. So, make time every day to interact with them. It may take several days, but continue until the horse is comfortable around you.

- Learn how to approach the horse: Once you can get close enough, you’ll have to learn how to approach the horse without spooking them. The best way to approach any horse is from the sides. They cannot see you if you approach them directly from the front or behind.

- Help them recognize your touch: Approaching from the sides, try to touch the horse. If they resist, rub the lead rope on their body while gently rubbing your hands on the neck. The horse is comfortable with your touch if they move closer to your body and nervous if they move away. Again, you may have to try a few times.

- Earn trust through grooming: Grooming a wild horse is risky. So, only move to this step once the horse is comfortable with our touch. Use a soft brush to gently rub the horse across the body while maintaining contact with the body using the other hand. More importantly, ensure the horse can see you. A 10-minute grooming session every morning can do wonders for your budding relationship.

Step #3: Haltering and Lunging

After bonding for 3-4 weeks through grooming and spending quality time together, the next natural step is haltering and lunging.

Haltering means putting the halter in place. Meanwhile, lunging a horse involves leading it via a long line (or lunge). Primarily, it introduces the horse to basic gaits and commands. Furthermore, longing teaches the horse that you’re the new leader of the “herd.” Therefore, they must respect you and follow your orders. Here’s how to proceed;

- Introduce the halter: If you’re attempting a DIY, fiddle ropes and buckles across the horse’s eyes during grooming to introduce them to halters. Then, gradually begin to show them the halter without attaching it.

- Prepare the halter: You don’t want to startle the horse by unbuckling it under their watch. So, unclip it in advance. Additionally, secure the lead line beforehand. It gives you greater control.

- Calm the horse: Get close to the horse so they can recognize you. Then, let them sniff your hands to calm them more. Stroking their neck and body helps to calm the horse further. A relaxed tail or gentle wagging are two signs the horse is comfortable.

- Secure the halter: From their left side, slip the lead line over the horse’s head and grab the loose end from under their neck. Then, grab the horse’s nose with your right arm and slide the halter over to the cheekbone using the left. Remember to buckle it securely.

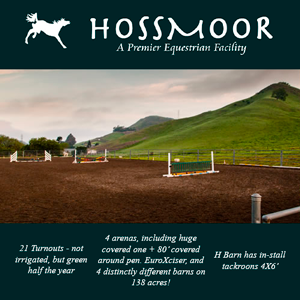

- Begin longing: Longing means walking the horse on a lunge (lead line). A circular arena with a 60-foot diameter is ideal. But an even bigger arena is desirable for wild horses.

Step #4: Actual training

The horse is ready for proper training once comfortable with the halter. Ideally, you want to begin with basic groundwork before moving to saddling and riding.

- Basic groundwork training: Groundwork is where you train the horse from the ground (not from their back). It’s where you learn to communicate with each other. Moreover, initial groundwork is an opportunity to establish your authority.

- Introducing the saddle: Start by showing the horse the entire tack to familiarize them with the smell. Then, gently set the saddle pad, followed by the saddle. Meanwhile, monitor the horse’s reaction and pause if they’re uncomfortable. You can always continue another day.

- Practice getting on the saddle: This is a new experience for wild horses. So, be gentle and considerate. More importantly, introduce weight gradually and only mount when the horse can handle your weight. Don’t ride on the first day.

- It’s time to ride: You can start riding after a few rounds of getting on and off the saddle. Begin with short walks for 5-10 minutes. Then, increase the intensity to trots and, finally, short canters. From there, you can take longer walks, trots, and canters and introduce full-speed gallops.

Read also: Situations Where Horses Wear Blinders.

FAQs

Can You Ride a Wild Horse?

Yes, you can ride a wild horse after taming and proper training. They are versatile athletes who excel in many sports, from pleasuring riding and endurance racing to dressage and jumping. However, don’t attempt to ride ferals or wild horses without training. It’s too dangerous.

Can You Tame a Mustang Horse?

Yes, you can tame a Mustang. But it’s best to do it at a special facility under professional watch. Moreover, the process takes longer than training a regular horse. The good news is that a professionally tamed Mustang is as friendly and easy-going as a regular horse and can be ridden without trouble.

Real-Life Techniques for Success

Wild and free-roaming horses are among the cheapest, costing as little as $125 at the Bureau of Land Management (BLM) adoption centers.

But, you must tame them before fully domesticating them. Otherwise, the horse poses a safety risk or may bolt off back to the wilderness. Thankfully, anyone with strong equine skills can tame a wild horse.